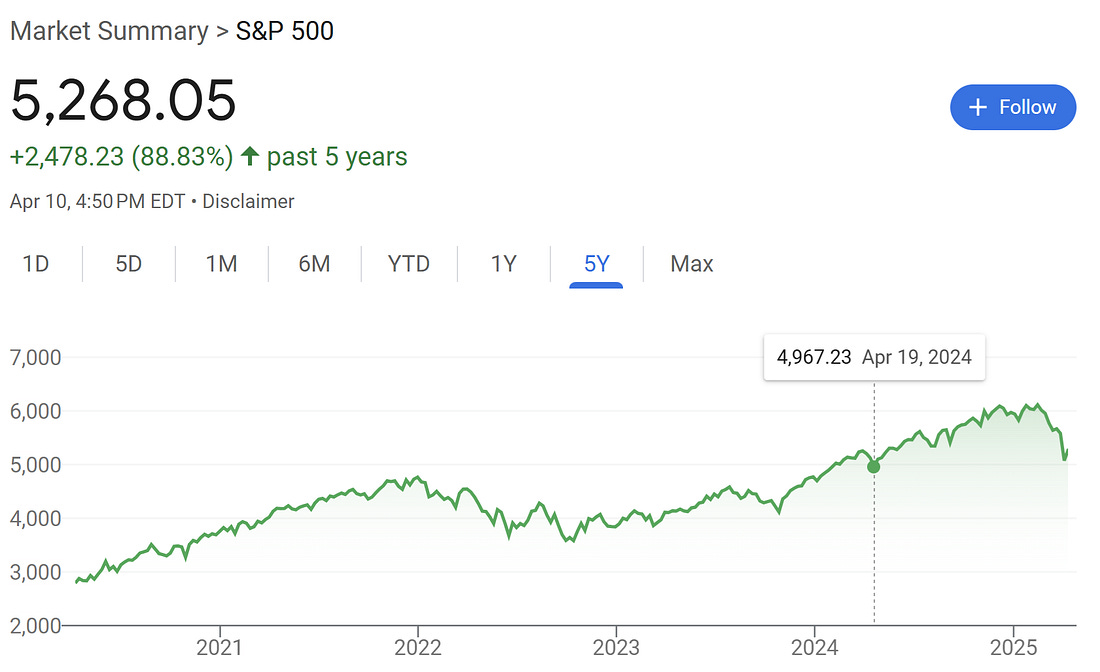

This week a previously unimaginable thing happened: a broad coalition came together to successfully resist President Trump. CEOs and their retired workers, financiers and academics, the DOGE Bros and federal workers, even D’s and R’s came together to turn back Trump’s tariffs. And they did it in the name of protecting the only American institution everyone agrees cannot fail: The stock market. And while I know a lot of people are pleased that a Trump policy was finally stopped, I worry that the reason this specific policy was stopped reveals a deep sickness in our nation. Think about it. We can’t come together to save our air, our water, or our planet. We can’t unite against adversaries like China or Russia. We can’t agree on feeding hungry kids, developing the next generation of energy, fixing healthcare, or preserving vital services. But when the stock market falls from whatever its current artificial high is back down to a level last seen… let me check… less than a year ago—and is still higher than every point in history prior to 2024, everyone loses their collective minds and revolts at the idea of their hard un-earned money from the last year disappearing. As a kid in the 90’s, I was fascinated by a DOW ticker next to Zesto’s ice cream shop on the main drag in my hometown, Jefferson City. I watched it obsessively as we drove back and forth across town for years. In middle school, I asked my teachers about the stock market and how it worked. I remember them saying it was like gambling. It’s not a sure thing, they told me, it’s risky. Naturally, I was confused, since I had watched the stock market consistently go up for years, so I asked for second and third and fourth opinions. But I kept getting the same answer from everyone, including my parents and people down at church: the stock market is gambling, and people without a lot of money can’t afford to take risks like that. This was both the truest statement and greatest lie I’ve ever been told. It’s the truest statement because, certainly, people without money can’t afford to gamble everything they have on risky ventures. But it’s the biggest lie because, in my lifetime, the stock market has never been a risk at all. Instead, it has been guaranteed by the largesse of the United States government. Every time the stock market has gone down, our government and politicians have done literally everything they could to get it back up again. It’s the most protected institution in America. Politicians of both parties point to its increases as roaring successes. In this case the great truth, that working people can’t afford to take risks, is the foundation for what makes the great lie, that the stock market (as a whole) is risky, untrue. It wasn’t always this way. Once upon a time the stock market was risky. But years ago, the financial class realized that if they could get everyday people across our country bought into the stock market, the government would be forced to insulate the market from risk. And, sure enough, they got us. Their hook? Convincing America to ditch fixed benefit pensions (which some corrupt companies had gutted in a spectacular manner) for stock-based individual retirement accounts. The original legislation for those accounts was put into place in the 1970s. But in the 1980s, employer sponsored 401(k) plans began to explode as the Reagan administration passed tax cuts and tax code changes that made 401(k) plans more desirable to everyday workers—and legitimized the accounts by creating a 401(k) program for federal employees. A few years later, Bill Clinton picked up the baton and expanded 401(k)’s to small businesses. The IRA followed a similar timeline to the 401(k) and, by 2010, millions of working people and retirees who could not afford to gamble with their retirement money or risk losing any of it, had a vast percentage of their net worth and their entire ability to survive later life tied up in the stock market. Wall Street literally took control of our survival. I saw this over and over again on the campaign trail. Desperate retirees clinging to underfunded retirement accounts and social security, praying that the stock market would explode and stretch their $80,000 401(k) plans a few years longer. You can see it right here on my Substack if you go back and look through old comments. I frequently get negative comments when talking about the financialization of our economy and what it has done to the income gap, services, opportunity, security, and independence of everyday people living in our country. I don’t blame the people writing them, the threat is real. For example, in response to one of my pieces on how the shareholder class is stripping our country for parts, one of my supporters, Norm, replied with the following: “By “shareholder class” do you include the millions of Americans who have worked hard most of their life, saved, and invested in American businesses so they could retire comfortably in a home they own? Do you mean us heretofore loyal Democrats who support Democratic public servants up and down the ballot both financially and with our gifts of time? Just want to be clear who you are demonizing here.” The answer, Norm, is no. You are not the shareholder class. You and millions of other hardworking Americans— nurses, teachers, truck drivers, laborers, and even Marines (yes, they switched our pensions to this)— are being held hostage by the shareholder class for their own massive profits. It’s gotten to the point, as we saw this week, that we must stand behind Wall Street whenever their source of free wealth is in jeopardy because we won’t survive old age with any measure of dignity unless we prop them up. That’s why you and your Republican neighbors and the top .01% all came together and took a stand against Trump’s tariffs. Not because they were stupid, or because they were mean, or anything like that. There are thousands of things going on that are stupid and mean that America doesn’t blink an eye at or do anything about. For God’s sake, millions of American children are going to bed hungry tonight, and have gone to bed hungry for decades, and a small fraction of what we put toward making the stock market as risk-free as possible would have cured their hunger a thousand times over. And the worst part is, that in order to keep stock prices up, for decades we have overspent, overleveraged, and gutted everything that was meant to protect us while the financiers gobbled up our companies and industries and stripped them for parts. It’s an American tragedy. And I mean that in the classical Greek tragedy way. As I wrote about in America the Business, our country has been living off an inheritance of production and creativity as we slowly sold off and shipped overseas everything that our forefathers built between the Great Depression and the 1980s. And although we don’t talk about it a lot, we are slowly running out of things to sell off and ship away. And as that happens the cold hard truth that we never invested in anything is going to catch up to us. Given the current arrangement, that’s going to push to more and more desperate measures to keep the market afloat and stave off any corrections to the value of stock indices that are artificially inflated by government money, massive tax cuts, and deregulation. Unless something drastically changes, working people in this country will have no choice other than to watch it happen and pray that they’re dead by the time the whole thing crumbles down around us. That’s the reality because the financiers made sure that the people who could least afford exposure to market risk are now the most exposed. We can still break free, but the only path I see is to do something counter-intuitive: to let go of the desire to join in on the shareholder class’s “free money” and ditch our reliance on the markets for reliance on one another and ourselves, by making social security a real and livable prospect for everyday Americans. That move would free our country from making terrible finance-sector driven decisions, would un-tie us from a class of people who have created the greatest income inequality in a century, and, in the end, I suspect it would be far less costly for all of us to put our IRA and 401(k) contributions into a social security type system than it is for us to keep spending unfathomable sums and feeding inflation by propping up the stock market and the corrupt businesses that populate it. The shareholder class, of course, knows that, and its why they fight everyday and spend billions in campaign contributions advocating for the opposite to happen— for social security to be privatized. If that vice ever closes, we truly will never escape. If you have any other ideas for how to turn it around, I’d love to know. Please share them in the comments! Lucas You're currently a free subscriber to Lucas’s Substack. For the full experience, upgrade your subscription. |

Thursday, April 10, 2025

The Greatest Trick They Ever Played

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.